07 Apr 2022

3i announces the sale of QSR to Datwyler for $625m

- Private Equity

- Industrial

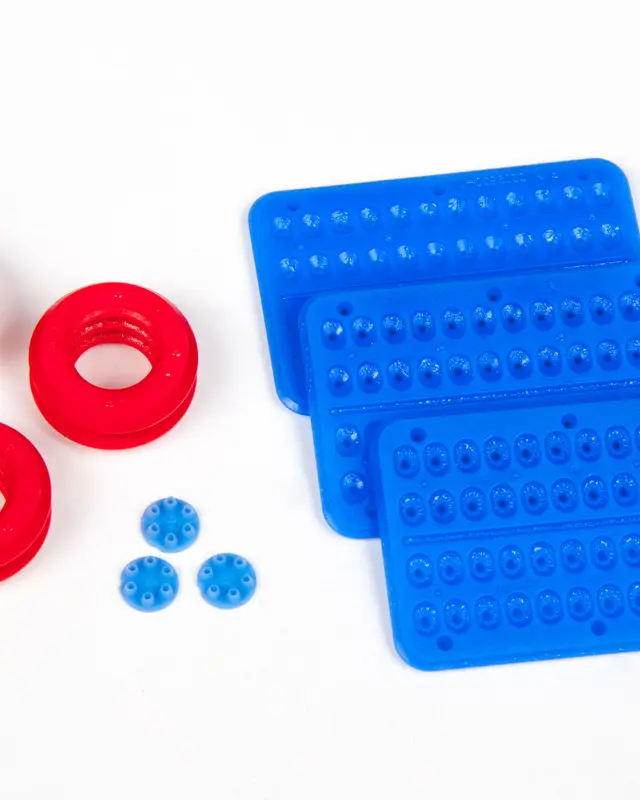

Proceeds from the sale of QSR will be used to retire the Q loan facility and return substantial capital to 3i and other investors. Following the transaction, Q Holding will consist of the current Q Medical Devices business, a leader in the production of outsourced medical devices for the cardiovascular and endosurgical markets, as well as critical silicone and other elastomeric components for the medical device and pharmaceutical markets.

Headquartered in Ohio, United States, with operations in North America and Asia, QSR’s sealing technologies offer world class and mission-critical solutions designed to safeguard electrical connections in the harshest environments such as mobility, industrial and aerospace settings. QSR’s products support a greener, safer and more connected world and are widely adopted in electric vehicles, autonomous driving applications and connectivity applications. QSR has unmatched material science, tooling, product engineering and process technology, and a history dating back to 1966.

3i invested in QSR parent Q Holding in 2014 and during its ownership has invested significantly to build and expand QSR’s manufacturing footprint in Mexico and China, grow QSR’s capabilities serving fast-growing markets such as high voltage EV applications, and support deployment of best-in-class manufacturing solutions to deliver the highest quality products to QSR’s customers.

Rich Relyea, Partner, 3i, commented: “QSR’s offering and expertise are unmatched and we are proud to have supported the tremendous QSR leadership team in executing its strategy. The Company has achieved significant growth globally, has provided its industry-leading customers with advanced solutions for exciting markets such as the electric and hybrid-electric vehicle industry, and has created a pathway for continued future growth for its new owner. We are simultaneously excited to continue our partnership with Mauricio and the rest of the Q team in expanding Q Medical’s world-class offerings to the high-growth global medical device industry.”

Mauricio Arellano, CEO, Q Holding, added: “We are incredibly proud of the business we have built and the quality of the team we have assembled to serve our customers. We are confident QSR’s team, capabilities and expertise will be a strong fit with Datwyler and we are looking forward to taking the next step in Q’s development with our partners at 3i.”

The transaction is expected to complete in Q2 2022, subject to customary antitrust approvals.

-Ends-

For further information, contact:

|

3i Group plc Silvia Santoro Shareholder enquiries

Kathryn van der Kroft Media enquiries |

Tel: +44 20 7975 3258 Email: silvia.santoro@3i.com

Tel: +44 20 7975 3021 Email: kathryn.vanderkroft@3i.com |

Notes to editors:

About 3i Group

3i is a leading international investment manager focused on mid-market private equity and infrastructure. Its core investment markets are northern Europe and North America. For further information, please visit: www.3i.com

About Q Holding

Q Holding is a leading global manufacturer of highly-engineered, fully assembled medical devices and precision-moulded elastomeric components used in a broad range of Life Sciences (medical and pharmaceutical) and Electrical Management (industrial, automotive and aerospace) applications. Headquartered in Ohio, it sells products in over 50 countries and has 13 manufacturing locations in North America, EMEA and Asia.

Regulatory information

This transaction involved a recommendation of 3i Corporation, a US wholly owned subsidiary of 3i Group. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities in this release. For data relating to other assets involving a past recommendation by 3i Corporation please go to our website.