Debt investors

We aim to keep our stakeholders well informed about the performance of the Group and to present our results in a form that is most appropriate to their particular needs. This section is aimed primarily at those whose main focus is the covenant of 3i Group plc as a borrower.

Outline of funding policy

Our borrowed funds are obtained from banks and capital markets.

We operate a conservative balance sheet strategy and prudent approach to liquidity management. We may raise debt or use other financing from time to time, to manage investment and realisation flows.

We aim to operate within a range of £500 million net cash to £1 billion net debt, with tolerance to operate outside of this range on a short-term basis and up to a gearing level of 15% dependent on investment and realisation flows. We have no appetite for structural gearing which means that achievement of our returns objectives is not reliant on gearing.

All of our borrowings are repayable in one instalment on the respective maturity dates and none of our interest-bearing loans and borrowings are secured on the assets of the Group.

We manage liquidity conservatively; maintaining a RCF to provide additional committed liquidity and financial flexibility, and monitoring using a framework that assesses forecast cash flows and a broader range of factors.

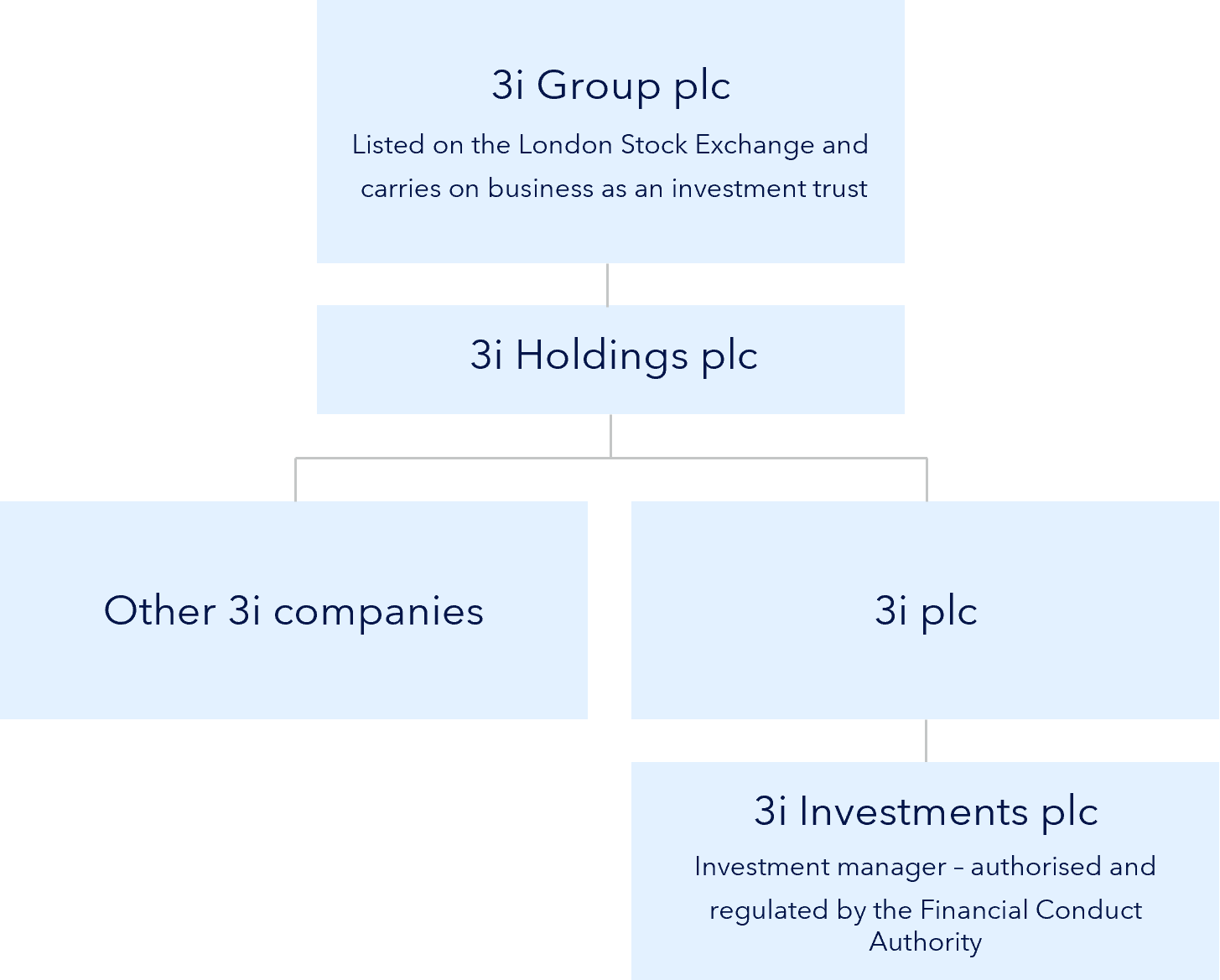

Group structure